China Tax: What Should You Keep in Mind?

China Tax: What Should You Keep in Mind?

We would like to thank Rob te Braake of ABEL Finance, and Michiel Vos of MS Advisory, who have helped 1421 put together this article.

Considering which taxes apply to your company is an important step when setting up a company in China. Many people are interested to learn more about taxes in China. In this article we will try to show you the taxes involved when operating a company and relevant to newly set up businesses in China. There are many different types of taxes applicable to foreign invested companies or foreigners. To make the overview of China tax system easier, we will divide the taxes amongst seven different topics:

1. Value Added Tax

The first China tax we will elaborate upon is the Value Added Tax (VAT). In China there are two types brackets for the VAT status of a company, small-scale tax payers and general taxpayers. Generally speaking, small taxpayers are companies in China with an annual revenue below 5,000,000 RMB (720.000 US Dollar), such companies generally pay 3% VAT. However, if you are a small-scale taxpayer VAT is not deductable and becomes a direct cost to your business.

In Beijing, if a small scale entity does not meet the standard revenue line, they can still apply to be treated as a general tax payer. For this a detailed application has to be filled in before it is accepted. Once the company has received the general VAT tax payer status, VAT can be deducted,which can be beneficial in terms of tax control. Furthermore, deductible VAT can be issued to other companies, without the need of interference by the tax office.

This is particularly interesting for companies that have trading and/or manufacturing activities in China, since these companies generally are subject to a high(er) amount of input VAT. For consulting or services industries, the major costs are generally the salaries of employees. These companies are generally not subjected to a substantial high amount of input VAT. Therefore, it is often more interesting for SME companies within the consulting and/or services industry to keep small scale VAT tax payer status. However, whether or not to keep the small scale tax payer status or to become a general VAT Tax payer depends on the business model of the individual company.

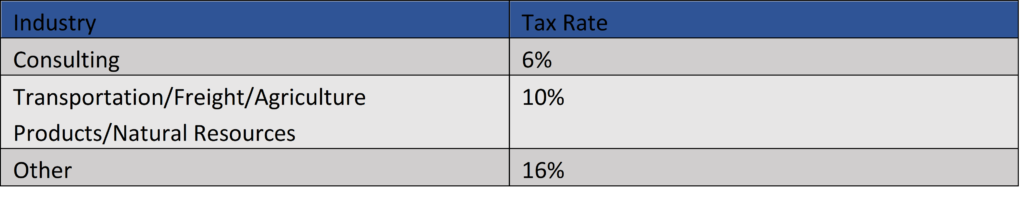

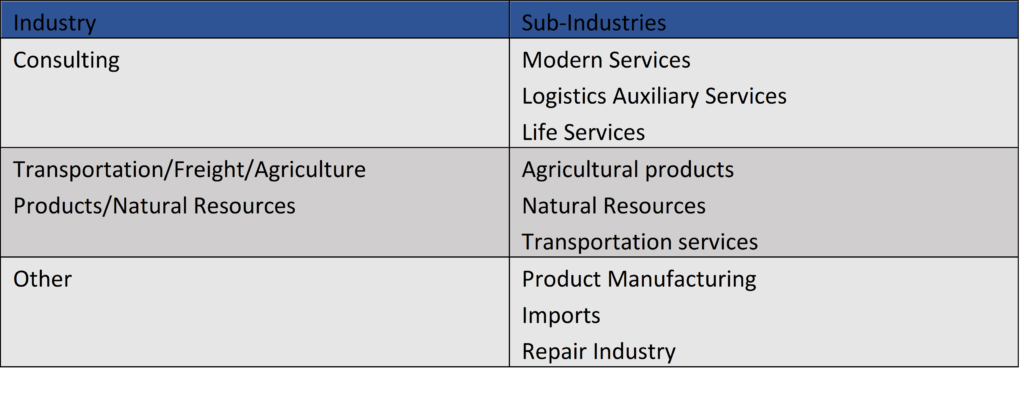

The general tax payers are divided per type of industry and each of these types include a range of specific sectors and industries.

Consulting/Service:

- Modern Services

Focusing on manufacturing, cultural industry, modern logistics industry and other business activities to provide technical, knowledge-based services. Including R&D and technical services, information technology services, cultural and creative services, logistics support services, rental services, authentication and consulting services, radio and television services, business support services and other modern services.

- Logistics Auxiliary Services

Includes aviation services, port and wharf services, freight and passenger terminal services, salvage and rescue services, loading, unloading and handling services, warehousing services and delivery services.

- Life Services

Refer to all kinds of service activities provided to meet the daily needs of urban and rural residents. It includes cultural and sports services, education medical services, tourism and entertainment services, catering and accommodation services, residents’ daily services and other life services.

Transportation/Freight/Agriculture Products/Natural Resources:

- Agricultural products

A wide variety of products. Examples are grain, edible vegetable oil, agricultural machinery, feed, pesticides, agricultural film, fertilizer & biogas.

- Natural Resources

Examples are liquefied petroleum gas, natural gas, edible vegetable oil, air conditioning, hot water, gas, household coal products, heating & tap water.

- Transportation services

The transport of goods and people from one point to the other. This can be done by air, road or rail.

Others

This includes industries such as product manufacturing, the repair industry, and imports.

In case of companies that have “mixed sales”, i.e. providing goods (16%) and services (6%) at the same time, the highest VAT rate (16%) needs to be chosen for every transaction.

Furthermore, a surcharge to VAT is levied in China. These surcharges can differ slightly per district. The most common surcharges are the Urban Construction and Maintenance Tax (UCMT) at 7%, the Education Surcharge (ES) at 3% and the Local Education Surcharge (LES) at 2%. Usually, this totals the amount of 12% of surtaxes on VAT to be paid. The amount of surcharge may differ in different regions in China. These surcharges do not have to be mentioned in the invoice to the customer in China. However, it is good to take these surtaxes in mind when determining the pricing.

When exporting goods from China, companies may be able to receive export VAT rebate. We advice to consult tax specialists to see whether your company is able to apply for the VAT refund and how much you will be able to receive from the relevant authorities.

2. Corporate Income Tax

According to the Corporate Income Tax (CIT) law, which came into effect on 1 January 2008, all enterprises in China are subject to CIT. Both local and foreign companies are subject to a uniform tax rate of 25%. Additionally, some organizations may experience a preferential income tax rate of 15%, if they qualify as high-tech or technology advanced services companies. It is important to understand which of the industries are encouraged and if your Foreign Invested Entity (WFOE or JV) is applicable for the special rate. You can find out more about encouraged industries in our article on that topic .

Corporate Income Tax is calculated based on revenue, minus costs, operating tax and several expenses. As a result, CIT is calculated according to the following formula:

Corporate Income Tax = (revenue – costs – operating tax – expenses) * 25%

Previously, companies in China with less than RMB 1 million in taxable income are exempted from paying corporate income tax on 50% of their taxable income, whereas the other 50% will only be taxed at a 20% CIT rate.

However a recent announcement by the State Council expanded these preferential policies for SMEs and low-profit enterprises. Now companies in China that have less than RMB 1 million in taxable income,are exempted from paying CIT over 75% of their taxable income and will pay the 20% CIT rate over the remaining 25% of taxable income. This means that taxable income up to 1 million RMB is effectively subject to a corporate income tax. of 5%

Additionally, this announcement also stated that if companies have between RMB 1 million and RMB 3 million of taxable income, they will be exempted from paying CIT over 50% of their taxable income and again the remainder of taxable income is subject to the 20% CIT rate. Similarly, this means an effective corporate income tax rate of 10%.

Often, Free Trade Zones (FTZ) offer deductions for income tax for a certain period of time. However it is important to check the legislation of the respective FTZ. Furthermore, often a minimum investment in the company is required.

The standard corporate income tax rate or “withholding tax rate” for dividends, interest and royalties to overseas is 10% in China. Differences may apply following the provisions of the double taxation agreements between China and your country.

3. Individual Income Tax

Individual income tax (IIT) is a progressive rate depending on the salary. The IIT in China ranges between 3% and 45%. In the past we have written a separate article on the individual income tax.

As of January 1st 2019, the Chinese tax authorities have introduced significant reforms to the previous individual income tax law, which allows more opportunity for both local and foreign employees for tax planning and reduced the overall tax burden. Our partners of MS Advisory have written an interesting article on what the impacts are of the changes in IIT. You can find it here.

4. Property & Deed Tax

Both of these China taxes are related to the acquisition and ownership of property. The tax on real estate is imposed on the owners, users or custodians of houses and buildings. The tax varies between ownership and rent. If the owner of the house lives in the apartments themselves, the tax is 1.2% over the original value minus 10-30%, whereby the 10~30% depends on the city. However, if the owner of the apartment is a company and rents out the house, then the rental tax is 12% of the rental value. If the owner is a person and not a company, the tax is 4% of the rental value.

The other China tax related the property is the deed tax. This is a tax on all transferees or assignees on the purchase, gift or exchange of landownership to use the rights or properties. The amount of the tax ranges between 3% and 5%.

When acquiring or transferring ownership of property, we advice to contact tax professionals to asses your situation and possibility of tax optimization.

5. Resource Tax

This tax is levied on natural resources. The tax, first introduced in 1984 orginally appied to crude oil, natural gas, coal and/or other mineral resources. A reform took place in 2016 and expanded not only into new categories, the taxation rules are different now and predominalty based on on the volumes that are used. Rates are set by the Chinese Ministry of Finance.

6. Taxes Based on Behaviour

Even though all of these are separate China taxes, we like to group them together based on the common denominator that they are based on behaviour. There are three types of behaviour taxes: Vehicle and vessel tax, motor vehicle acquisition tax and stamp tax.

Vehicle and vessel tax is at a fixed amount on the owners of vehicles. Motor vehicle acquisition tax is 10% of the purchase of all types of motorised vehicles. Stamp tax is levied on individuals or enterprises receiving documentation in China. The taxes are very small, between 0.005% and 0.1%. The stamp tax is on contracts & agreements which are signed with a stamp, instruments for transfer of property, business accounting record, licenses & certificates and other instruments as specified by the Ministry of Finance.

7. Custom Duty

Custom duties are charged on goods which are imported to China. The goods are assessed on costs, insurance and freight value. The rate depends on the nature of the products and country they come from. This is very dependent on the HS codes of the product.

There is also a customs duty levied on exports of certain categories of goods in China. This is more rare tax and usually applies to either more rare natural resources originating from China or Chinese traditional medicine.

China Tax is Very Complex

The tax system in China is highly complex and changes often. Knowing what to expect with regards to China tax will make running your business much easier. Taxes are applied differently based on the region you are operating from, or the business segment you are operating in. Being compliant in China, or as we like to say Chinable is increasingly difficult and the costs attached to non-compliance are going up.

1421 Consulting has tax specialists that can help you with the difficulties of Chinese taxes. If you are unsure which taxes you should file for, or if you do not know how to approach the filing of a China tax correctly, you can contact us and we will help you be Chinable and prevent unnecessary costs.

We would like to thank Rob te Braake of ABEL Finance, and Michiel Vos of MS Advisory, who have helped 1421 put together this article.

Related posts