China E-commerce Market Trends that Foreign Companies Should Know

China E-commerce Market Trends that Foreign Companies Should Know

Based on the future, we discovered the China e-commerce market trends which are crucial for foreign companies. This article is the third in our tetralogy of insights in the China E-commerce market. Our first article can be found here and our second article here. Knowing how the market will develop in the future is half the battle and invaluable to strategise online market entry. For a full overview, request our China e-commerce white paper:

Shift from C2C to B2C

One of the clearest China e-commerce market trends over the past years in China e-commerce, is a distinct shift from customer-to-customer (C2C) to business-to-customer (B2C) sales. Up to now, it has been very common for consumers in China to buy products from other consumers through Taobao and Microboss. Most of all, because of the wide assortment of products and the lower price of buying products through C2C channels. Sellers are able to offer anything from hand-made goods to manufactured products for a low price. Buying products such as clothing, electronics, homemade goods, custom made goods can often be found on C2C online platforms. Just as online platforms like EBay, the selling party is also a consumer, not an operational business. The C2C online market accounted for almost 90% of online shopping in 2008.

However, nowadays this trend is changing; the C2C online market has dropped to 48.1% between 2008 and 2015 (Figure 1).The current trend among Chinese consumers is to buy from businesses (B2C). Which, considering the low prices of the products is a curious switch. The challenge with the C2C market is the unreliability of the product; they can easily be fake or have poor quality. Chinese consumers are becoming increasingly less happy with purchasing products they want or need for low prices and low quality. On the B2C market place, the consumer runs a much lower risk of buying cheap or poor quality products. Brand products and products with higher quality are becoming the desired products among Chinese consumers.

Online platforms like JingDong, T-Mall, VIPSHOP, Yihaodian, Suning and Little Red Book concentrate their sales on the B2C market. For Chinese companies which are already active in the B2C market, their sales can be expected to rise as consumer’s demands for B2C products increase. For foreign companies, JingDong Worldwide, T-Mall Global, Suning, Yihaodian, Dangdang, Amazon China, Little Red Book and VIPSHOP International are interesting alternatives to sell products to Chinese consumers on a B2C platform. The market for B2C in China now has more opportunities as Chinese consumers shift from the C2C to B2C market, creating various opportunities for foreign companies offering their products to Chinese consumers.

Nowadays, at online C2C markets, consumers do not always trust the sellers. Sellers have been known to put misleading pictures and descriptions about products, which means consumers are left with a poor quality products. Of course, this means that all consumers have to do is comment on the sellers web shop about how misleading the actual product is as a warning to other consumers. However, it seems that consumers have had enough of simply warning other Chinese consumers about fake or poor quality products and are turning to the B2C market for quality products because of the reliability of the product.

B2C markets are more likely to be products of higher quality, but at a higher price. The higher price, however, does not seem to be discouraging Chinese consumers from buying B2C products. Online platforms with a B2C focus already emphasise on selling quality products and keeping sellers with fake or poor quality products off their websites. With this in mind Chinese consumers can shop with a peace of mind because they are buying are quality products.

For foreign companies entering the Chinese e-commerce market place this trend of C2C to B2C and Chinese consumers demand for better quality is positive. As the perceived quality of foreign goods is still better than local products, non-Chinese companies have more opportunities to sell to Chinese consumers.

Governmental rules are also becoming more focused on the B2C market.

Besides the consumer’s thirst for quality and thus creating a shift from C2C to B2C, the Chinese government would like to see more B2C markets and products become a larger part of Chinese consumer’s lives. B2C companies therefore have the backing of the Chinese government. For example, following the Chinese government’s move to slash the hefty imported tariffs on imported cosmetics products with effect from 1 October, 2016, a number of international cosmetics brands, including Estee Lauder, Dior and Amore Pacific, have lowered the prices of color cosmetics starting January 2017. The price reductions, ranging from 5% to 30%, are mainly imposed on high-end brands.

Online platforms have global selling platforms that are concentrating on selling B2C products from companies outside of China that want to sell to Chinese consumers. This allows greater accessibility for companies to sell to Chinese consumers from abroad. This option is good for foreign companies that cannot move their entire operations to China, but still want to target Chinese consumers. Some of the larger online platforms that focus on the B2C market even have options to store foreign company products and offer delivery for these companies. With the correct approach and advice from experts in China, Chinese consumers can be marketed to and will buy foreign products from companies abroad.

Use of Social Media

Social media such as WeChat and Weibo are becoming increasingly important to the decision making process of Chinese consumers and thus the overall marketing of a brand in China. Social media is used by consumers to rate, discuss and recommend products, and can also be used by brands for marketing. WeChat Offical Accounts currently has over 500 million subscribers in China and is extremely popular among the younger and affluent demographic. Chinese consumers regard shopping as more than just the transaction. It’s about entertainment, discovery, and social engagement with friends, celebrities, and internet influencers. For foreign companies it is therefore extremely important to think about the marketing and branding of their products. Expecting sales to automatically skyrocket after simply launching an e-commerce market place is foolish as competition is fierce.

Incorporation of Low-Tier Cities and Rural Areas

With the empowerment of the smart logistics systems, e-commerce is providing consumers located in the inland provinces and lower tier cities. First tier cities are Shenzhen, Beijing, Shanghai and Guangzhou. Lower tier cities mean less developed cities and markets underserved by traditional brick and mortar retail channels, without access to an expanded selection of both foreign and domestic products.

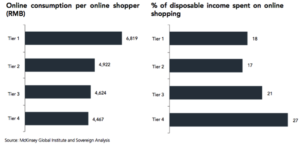

Online shoppers in Tier 1 cities spend the most money buying products from e-commerce channels; however, online shoppers in lower Tier cities (i.e. Tier 3 and Tier 4 cities ) spend a higher percentage of their disposable income shopping online (figure 2). Important for foreign retailers to know which market are they specifically targeting. Planning ahead of the competition and targeting lower tier cities might fill a niche in the market currently unexplored.

Online shoppers in Tier 1 cities spend the most money buying products from e-commerce channels; however, online shoppers in lower Tier cities (i.e. Tier 3 and Tier 4 cities ) spend a higher percentage of their disposable income shopping online (figure 2). Important for foreign retailers to know which market are they specifically targeting. Planning ahead of the competition and targeting lower tier cities might fill a niche in the market currently unexplored.

If your company is looking into entering the China e-commerce marketplace and target the vast amount of Chinese consumers, keeping an eye on the China e-commerce market trends is important. We recommend every company to analyse their market, before making decisions. Should your company need assistance in mapping out the opportunities, then 1421 has the professionals to assist with your market entry analysis. Feel free to reach out at info@1421.consulting for advice with no strings attached.

This article was written by Maxime Van ‘t Klooster and Nathan Jansen. Special thanks goes out to Ruoyi Xi. For more information, please request our China E-commerce White Paper.

Related posts